Duration

Duration is the rate-sensitive value of the bond and not the time of the bond. The person who bought the bond will have the break-even of the price where he is not affected by the interest rate risk in the market. Duration is named after Macaulay. So it is called the Macaulay Duration.

Modified Duration

Modified duration is the measure of the difference between the rate changes in the market. Fluctuations in the value of a bond is measured, with respect to change in the interest rate in the market.

Suppose a 1 % change in the rate the bond value also changes with this the investor who invested on the bond will come to know if he is incurring loss or profit.

Duration is very important concept and will be asked in the exam every year. This is very tricky question and time consuming. So it is normally asked in the form of case study. Very important topic of CAIIB, BFM Marketing risk management.

EXAMPLE

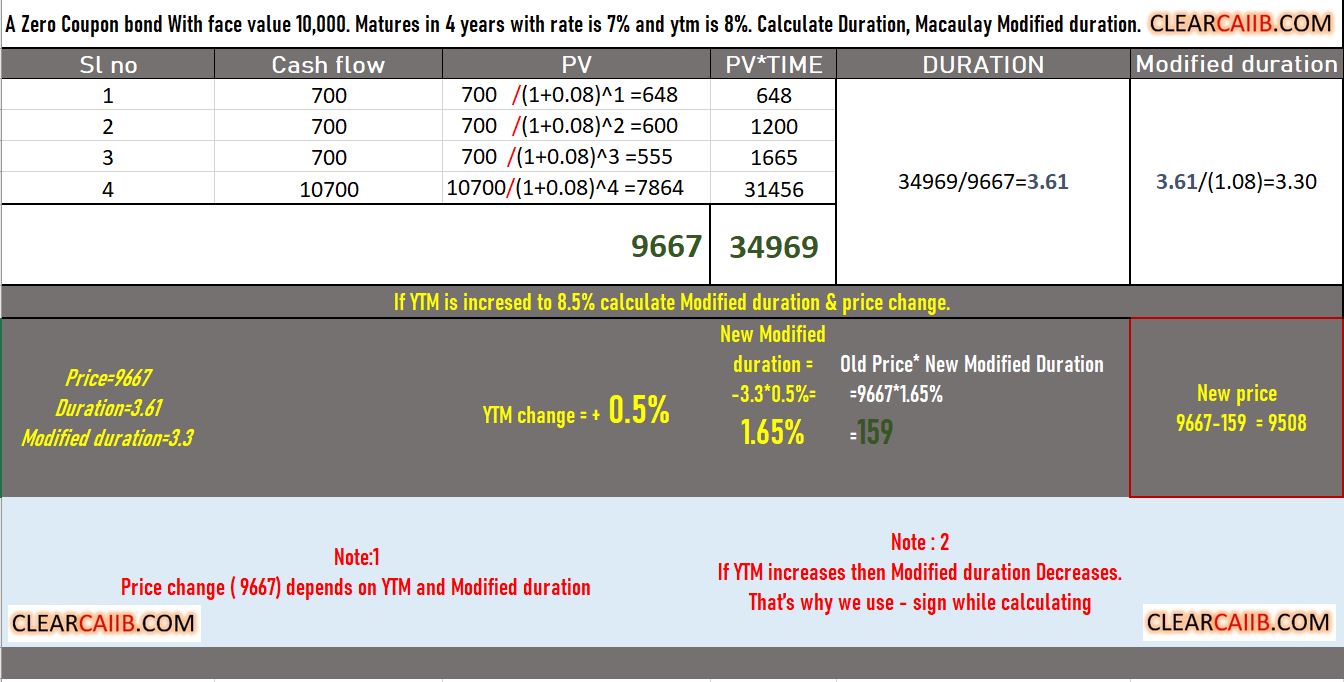

A ZERO coupon bond with face value of 10,000 and it will mature in 4 years. The rate of interest is 7% and YTM is 8%. Calculate Price of the bond, Duration of the bond, Macaulay Modified duration.

Also calculate price of the bond if YTM is changed to 8.5%. This is the latest model 5MARKS CASE STUDY question asked in CAIIB, BFM Exam held in FEB 2022.

We have to calculate present value (PV). Sum of all cash present values is the Price of the bond at present i.e. 9667.

Calculate ( PV * Time/Bond price ) we will the Duration of the bond i.e 3.61.

To calculate Macaulay Modified duration the formula is Duration / (1+ytm). With this we have 3.61/1.08 i.e. 3.3

Now New YTM is increased to 8.5% i.e 0.5% more than the previous YTM. To calculate New Macaulay modified duration we need to calculate

1)New Modified duration i.e 3.3*0.5=1.65%

2)New price of the bond decreases by = 1.65% * Previous bond price i.e 1.65%*9667=159

9667-159=9508

Note 1: Bond price change depends on YTM & Modified duration

Note 2 : If YTM increase then Modified duration decreases. Thats why we are using negative sign while calculating Macaulay Modified duration.